Crime Reports

See The Full Report By Clicking On And Scrolling Through The Document Below

Read more about it. Click here. ►

Say Hello To Your "Grandson" And Goodbye To Your Money

The "Hello Grandpa" scam is alive and well here in Manassas. The editor of this web site just got off the phone with a person who claimed to be his grandson. Having been duped once before six years ago by this same ruse yours truly immediately hung up and headed for this spot to warn that this fraud has not yet been defeated. Here's a link to an AARP web page that gives valuable information about this clever but evil scheme including information on how to avoid falling into this costly trap. Click this link. ►

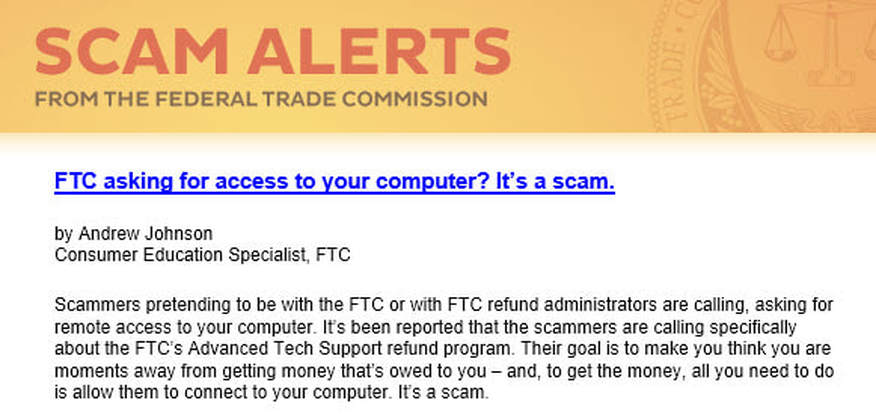

New Medicare Card Telephone Scam

If those on Medicare don’t already know, Medicare is issuing new Medicare cards. The process is supposed to start in April 2018, and could take as long as April 2019 to complete the process.

A friend emailed me that there is already a scam starting to take place (it doesn’t take long for someone to come up with an angle). Unfortunately, with a little research, I found out he’s absolutely correct.

One of the major differences with the new card is that it will no longer contain your Social Security number. Instead, you will be assigned an alphanumeric number to ‘identify’ you. Supposedly the only relationship to that number and your actual Social Security number is the fact that Medicare is the only one to know that number assigns to your Social Security number.

According to the Medicare administration, they’re not aware of any significant scam efforts. Of course, who’s always the ‘last to know’ – the people who are supposed to be in charge.

The scam has some variations but it essentially boils down to two categories at this point:

- Someone calls, claiming to be with Medicare, and says they need to verify some information before they can ship your new card. That’s BS because Medicare will NEVER call you (# 1), and they already have the

- Someone calls, claiming to be with Medicare, and claims that you will need a temporary card before your new card arrives. They then tell you that it will cost between $ 5 and $ 50, and need financial information from you

I fairly certain that, by the time the scam ‘gets more momentum,’ there will be other variations. The bottom line is your old card is good until you get your new one (actually, I suspect your old card will continue to be good for sometime time. We all know how the government works at times 😊 and, until they hammer out the bugs, my guess it that you’ll be able to use either card … although you should shred your old card when you get your new one).

Please let all your friends on Medicare know. This scam is real and, while it may not have a ‘strong foothold yet,’ it has potential. If someone calls you, hang up. Regardless of what lies they use to try to convince you, they aren’t true.

Manassas City Police Annual Report For 2017

The Manassas City Police Department has just posted their annual report for last year. At 26 pages in length it includes an intensive statistical analysis of the crime in our area from murder to fraud. It also includes charts showing the number of calls the police answered and the number of traffic accidents in Manassas. There are pages devoted to police response times, crash fatalities plus DUI and juvenile arrests. There's even a section on quality of life incidents. It is quite an informative document and we recommend giving it a once over. You can find it easily by just clicking on our linkage arrow. -►

How Easy It Is To Get Scammed Out Of Your Home

Kay Witt found this interesting story about mortgage scams that was recently published on the Washington Post web site. It's a recommended read and you can access it by clicking here.

Gift Card Scams

Fraud Advisory

'Smishing' scams target your text messages. Here's how to avoid them

By Marc Saltzman , USA TODAY

While the name of this growing threat might sound funny, being a victim of it is no joke.

Similar to a “phishing” scam — where computer users receive an authentic-looking email that appears to be from their bank, Internet Service Provider (ISP), favorite store, or other organization – “smishing” messages are sent to you via SMS (text message) on your mobile phone.

What does the sender want? To defraud you.

“Criminals like smishing because users tend to trust text messages, as opposed to email, of which many people are more suspicious, due to phishing attacks,” says Stephen Cobb, a security researcher at ESET, a global cybersecurity company.

“As smartphones are the primary means of accessing the Internet in some countries, this has tempted criminals around the world to invest in scams that target these devices.”

“That means there is no shortage of skills in this space, skills that criminals can tap to target cellphone users in any country they chose,” Cobb adds.

Related:

Phishing scams: How to get avoid getting duped

Watch out for tax scams on email, Facebook and your phone

Apple issues security update to prevent iPhone spyware

So, what does it look like?Cybercriminals are trying to lure you into providing account information — such as a login name, password or credit card info — by tapping on a link that takes you to a web site. Here they can get enough info to steal your identity. Or you might be asked to answer questions via text message or advised to call a phone number.

In some cases, you’ll receive a text message with a sense of urgency:

• Dear customer, Bank of America needs you to verify your PIN number immediately to confirm you’re the proper account holder. Some accounts have been breached. We urgently ask you to protect yourself by confirming your info here.

Sometimes, scammers try to capitalize on something timely, like tax filing season:

• “IRS Notice: Tax Return File Overdue! Click here to enter your information to prevent being prosecuted.”

Or, perhaps, it will come in the form of a more personal note:

• Beautiful weekend coming up. Wanna go out? Sophie gave me your number. Check out my profile here: [URL]

Or, you might fall for a smishing scam if you think you can win something:

• Your entry last month has WON. Congratulations! Go to [URL] and enter your winning code – 1122 – to claim your $1,000 Best Buy gift card!

What can you do about it?You can fight “smishing” in a few ways:

* If you get a suspicious looking text (or email) on your phone and it asks you to urgently confirm information, it's not coming from a legitimate institution. Therefore, don't reply and don't tap on the link in the message. Simply delete it. Your bank, financial institution, ISP or favorite online retailer will never ask for sensitive info this way. When in doubt, contact the company yourself. Even though you might be tempted to hit Reply and tell them to leave you alone, you’re only confirming your phone number is valid, which might invite even more scams.

* Anti-malware (“malicious software”) software exists for mobile devices, many of which can detect and stop a smishing attempt. This serves as an extra line of defense from these malicious types, but you must still exercise common sense.

ESET, the cybersecurity company Cobb is a researcher for, has a free Google Play app called ESET Mobile Security & Antivirus. Features include antivirus, remote lock and siren, GPS localization, and tablet support, while upgrading to Premium ($14.99/year) adds SMS and call filters, remote wiping, anti-phishing, photo snapshots (of someone trying to log into your device), and more.

Other providers of similar software include Norton Anti-Virus and McAfee. On a related note, be sure to always update your smartphone's operating system to the latest version.

You're sharing your cell phone number too frequently

* Look for suspicious charges on your monthly phone bill. Even if you never responded to one of these texts, it doesn't hurt to look at your itemized charges to see if there's anything that looks off. If it does, contact your phone provider right away to dispute the charges. Don't worry, they've heard it all before. Resist entering contests that ask you to provide your mobile number, as you’re setting yourself up for these kinds of scams. Similarly, don’t post your mobile phone number on social media or other public forums.

* When mobile shopping, stick with reputable retailers. When giving out financial information, like your credit card, always be sure to look for indicators that the site is secure, such as a little lock icon on the browser's status bar or a URL for a website that begins “https:” (the “s” stands for “secure”). On a related note, never tap on a link to a retailer to shop online -- just in case it's a scam. Instead, manually type in the store's URL (e.g. amazon.com) or use the store’s official app.

While the name of this growing threat might sound funny, being a victim of it is no joke.

Similar to a “phishing” scam — where computer users receive an authentic-looking email that appears to be from their bank, Internet Service Provider (ISP), favorite store, or other organization – “smishing” messages are sent to you via SMS (text message) on your mobile phone.

What does the sender want? To defraud you.

“Criminals like smishing because users tend to trust text messages, as opposed to email, of which many people are more suspicious, due to phishing attacks,” says Stephen Cobb, a security researcher at ESET, a global cybersecurity company.

“As smartphones are the primary means of accessing the Internet in some countries, this has tempted criminals around the world to invest in scams that target these devices.”

“That means there is no shortage of skills in this space, skills that criminals can tap to target cellphone users in any country they chose,” Cobb adds.

Related:

Phishing scams: How to get avoid getting duped

Watch out for tax scams on email, Facebook and your phone

Apple issues security update to prevent iPhone spyware

So, what does it look like?Cybercriminals are trying to lure you into providing account information — such as a login name, password or credit card info — by tapping on a link that takes you to a web site. Here they can get enough info to steal your identity. Or you might be asked to answer questions via text message or advised to call a phone number.

In some cases, you’ll receive a text message with a sense of urgency:

• Dear customer, Bank of America needs you to verify your PIN number immediately to confirm you’re the proper account holder. Some accounts have been breached. We urgently ask you to protect yourself by confirming your info here.

Sometimes, scammers try to capitalize on something timely, like tax filing season:

• “IRS Notice: Tax Return File Overdue! Click here to enter your information to prevent being prosecuted.”

Or, perhaps, it will come in the form of a more personal note:

• Beautiful weekend coming up. Wanna go out? Sophie gave me your number. Check out my profile here: [URL]

Or, you might fall for a smishing scam if you think you can win something:

• Your entry last month has WON. Congratulations! Go to [URL] and enter your winning code – 1122 – to claim your $1,000 Best Buy gift card!

What can you do about it?You can fight “smishing” in a few ways:

* If you get a suspicious looking text (or email) on your phone and it asks you to urgently confirm information, it's not coming from a legitimate institution. Therefore, don't reply and don't tap on the link in the message. Simply delete it. Your bank, financial institution, ISP or favorite online retailer will never ask for sensitive info this way. When in doubt, contact the company yourself. Even though you might be tempted to hit Reply and tell them to leave you alone, you’re only confirming your phone number is valid, which might invite even more scams.

* Anti-malware (“malicious software”) software exists for mobile devices, many of which can detect and stop a smishing attempt. This serves as an extra line of defense from these malicious types, but you must still exercise common sense.

ESET, the cybersecurity company Cobb is a researcher for, has a free Google Play app called ESET Mobile Security & Antivirus. Features include antivirus, remote lock and siren, GPS localization, and tablet support, while upgrading to Premium ($14.99/year) adds SMS and call filters, remote wiping, anti-phishing, photo snapshots (of someone trying to log into your device), and more.

Other providers of similar software include Norton Anti-Virus and McAfee. On a related note, be sure to always update your smartphone's operating system to the latest version.

You're sharing your cell phone number too frequently

* Look for suspicious charges on your monthly phone bill. Even if you never responded to one of these texts, it doesn't hurt to look at your itemized charges to see if there's anything that looks off. If it does, contact your phone provider right away to dispute the charges. Don't worry, they've heard it all before. Resist entering contests that ask you to provide your mobile number, as you’re setting yourself up for these kinds of scams. Similarly, don’t post your mobile phone number on social media or other public forums.

* When mobile shopping, stick with reputable retailers. When giving out financial information, like your credit card, always be sure to look for indicators that the site is secure, such as a little lock icon on the browser's status bar or a URL for a website that begins “https:” (the “s” stands for “secure”). On a related note, never tap on a link to a retailer to shop online -- just in case it's a scam. Instead, manually type in the store's URL (e.g. amazon.com) or use the store’s official app.

Scamming Credit Cards

Scamming Credit Cards

|

Fraud

On June 7, 2017, the Manassas City Police responded to a residence on the 9200 block of Stonewall Ct for a report of a fraud. Officers spoke with an adult male victim, who stated he was contact by a company via phone, who advised him he needed to purchase a system which is designed to help him learn the English language. The victim was told if he did not pay for the language system, Immigration and Customs Enforcement (ICE) would be notified, and he would be arrested. The victim agreed to pay for the language assistance program. A few days later, the victim received a package in the mail containing English assistance books, DVD’s, and pamphlets. The victim then received a phone call from the same company demanded he pay a more substantial amount of money this time, or Immigration and Customs Enforcement was going to arrest him. The offender(s) in this incident also used a caller identification program which made the phone call appear it was coming from the Manassas City Police Department. The victim became suspicious and contacted police. ***The Manassas City Police Department will never ask for money in lieu of an arrest*** Crime Prevention Tip: DON’T FALL VICTIM TO TELEPHONE SCAMS! • Never give your information to persons who state they are from your bank or Credit Card Company. If you have concerns or questions about your account, contact your financial institution directly. • If you think a call may be fraudulent, HANG UP! The phone is yours – you decide to whom you would like to speak. If you would rather not hang up on someone, tell the caller you will have a family member speak to him or her instead. • Scammers will often pressure you and threaten you to act immediately. This is usually a warning sign of a scam. Don’t feel pressured to make an immediate choice. Time is on your side. • Remember, if a deal seems too good to be true, it probably is! • Be aware of caller identification spoofing. Just because the caller ID appears to be coming from a particular number, doesn’t mean it is actually coming from the perceived number. Report the incident to your local law enforcement agency. Larcenies from Auto Crime Prevention Tip: Larcenies from vehicle, theft of motor vehicle parts, and vandalisms to auto are the most commonly reported property offenses in the City of Manassas. Valuables left in plain sight inside a vehicle offer a tempting reward for criminals, especially if gaining access could be as simple as opening an unlocked door. To avoid becoming a victim of larceny, residents are strongly urged to consider the following tips:

1. Lock all vehicle doors and windows. (It doesn’t hurt to double-check. Many victims thought they had left their vehicles locked before the theft took place. “Before you sleep, make sure it beeped!”) 2. Park your vehicle in a well-lit and/or in a populous location 3. Conceal all valuables before arriving at your destination. Never underestimate the value of something to someone else. Even spare change can entice a thief to break in and steal other items once inside. 4. Report all suspicious activity by calling 703-257-8000. It never hurts to have a pen and paper ready by the phone in the event you are able to provide a description of what you saw. Crime Prevention Tip: Always Lock Your Vehicles. Tips for Protecting Valuables: Remove all items of value such as handbags, wallets, cell phones, MP3 players, laptops, and other electronics from your car when you are not driving. Take out removable radios and faceplates. The glove box and center console are usually the first place thieves look, so avoid leaving anything inside either one that they could get their hands on. Rather than covering items in your car with a blanket or jacket, take them with you. If you must leave them in your car, place them in the trunk prior to arriving at your destination so no one sees you doing it. Close all car windows completely and park in a well-lit area that is rich in foot traffic and close to your destination. Avoid parking between large vehicles that can provide cover for thieves. Defend yourself and your property at home using outdoor lighting, and take advantage of free security assessments offered through Manassas City Police Department. Make a decision not to become the target of crime, and report any suspicious activity to the police by dialing 703-257-8000. If you are witnessing a crime in progress or a dangerous situation, call 9-1-1 immediately. |

Crime Prevention Tip: Avoiding Fraud at Any Cost

Fraud is the deliberate deception of a victim with the promise of goods, services or other benefits that are non-existent, never intended to be provided, or grossly misrepresented. The number of internet fraud and scams is only limited to a criminal’s imagination. Follow these tips to avoid becoming a victim of fraud:

Fraud is the deliberate deception of a victim with the promise of goods, services or other benefits that are non-existent, never intended to be provided, or grossly misrepresented. The number of internet fraud and scams is only limited to a criminal’s imagination. Follow these tips to avoid becoming a victim of fraud:

- Never pay fees or a deposit upfront for something that would not normally have significant upfront costs, such as a sweepstakes. If a deal seems too good to be true, it most likely is. These amazing promises of goods, services or other offers are oftentimes sent out via e-mail. Pay no attention to them and delete them immediately.

- Never give out personal information such as your social security number or credit card numbers on unprotected internet sites. Make sure the website is protected before giving out personal information. If you are giving this type of information to a company for the first time, do your research on the business beforehand. Read reviews on the company and make sure it is a company that can be trusted. The Better Business Bureau is a great resource that provides consumers with useful information on businesses and their ratings. Visit the Better Business Bureau online.

- If you decide to meet someone in person to sell or buy an item from an online advertisement, make sure you have a friend or family member accompany you and communicate with others about your whereabouts. If possible, meet in a well-populated, safe location such as a restaurant or busy area of town.

The Latest In Police Windshields Comes To Manassas

Police officers in Manassas City have installed a new windshield that can help combat police impersonations.. This windshield offers a more secure relationship between the officer and the citizen in a routine traffic stop. Citizens will now know that they are safely being pulled over, without the need to drive to a lit area or call 911 for help. The hope is that this windshield will become the solution to the rapidly growing problem of police impersonation. The powerful flashing lights, built into the windshield, are invisible to the officer driving the car. Look at the YouTube Video be;low to see it in action.

On-Line Security Tips From The AARP

Here are five tips on what to avoid posting on social media sites, like Facebook and Twitter:

- Never post personal information, including your Social Security number (not even the last four digits), birthday, place of birth, home address, phone numbers, or personal account information. Any of these can be used to open bank or credit card accounts – or even loans – in your name.

- Avoid posting a full frontal picture of yourself on social media sites. A con artist can copy the image and use it to create a photo ID that can be used to steal your identity.

- Review and set privacy options for each of your social media accounts. Go to privacy settings and restrict your information so it can only be viewed by people you select. Check your privacy settings regularly.

- Don’t post things you may want to delete later. Nothing you post online is every truly gone if you delete it. So think twice about the pictures or comments you share before you share them.

- View your profile as others see it at least once a month. On Twitter, log on, click your picture, and select “View Profile.” On Facebook, simply click on your name to view your profile as others see it.

Scam Alert

The Ashburn Patch calls attention to a scam concerning unpaid electric bills in nearby Loudoun County. It's an old ruse that refuses to go away. Inform yourself about it by clicking here.

IRS Phone Scam

It’s that time of year, tax time. Don’t be fooled by fake phone scams from someone claiming to be with the IRS. See the tip below from the Federal Trade Commission for further details.

Crime Prevention Tip

Despite public perception, scam artists don’t discriminate based on age. Children, adolescents, adults, and seniors are ALL at risk for becoming a victim of fraud or identity theft. Spring is tax season, which is the perfect time for scam artists to target residents. Don’t believe callers, emails or texts that say they are from the Internal Revenue Service (IRS), even if they threaten to have you arrested for noncompliance. Tax identity thieves may send phony “phishing” emails that appear to be from the IRS and ask you to click on a link. They may also directly ask you to provide or confirm your personal information online or over the phone. Don’t do it! The IRS does not email, call, or text people to get personal information. If the IRS needs to contact you, they will do so by mail. Another red flag is if the caller asks for payment in the form of prepaid cards or wire transfer. If you have any doubt whether a message is legitimate, call the IRS directly or consult Police or a trusted family member. For more information click here.

For an actual attempted phone scam message left for one of Manassas finest click here.

Crime Prevention Tip

Despite public perception, scam artists don’t discriminate based on age. Children, adolescents, adults, and seniors are ALL at risk for becoming a victim of fraud or identity theft. Spring is tax season, which is the perfect time for scam artists to target residents. Don’t believe callers, emails or texts that say they are from the Internal Revenue Service (IRS), even if they threaten to have you arrested for noncompliance. Tax identity thieves may send phony “phishing” emails that appear to be from the IRS and ask you to click on a link. They may also directly ask you to provide or confirm your personal information online or over the phone. Don’t do it! The IRS does not email, call, or text people to get personal information. If the IRS needs to contact you, they will do so by mail. Another red flag is if the caller asks for payment in the form of prepaid cards or wire transfer. If you have any doubt whether a message is legitimate, call the IRS directly or consult Police or a trusted family member. For more information click here.

For an actual attempted phone scam message left for one of Manassas finest click here.

Here are some questions and answers from The New York Times about older people and fraud:

Are older people at risk for fraud only if they are wealthy?

No, Scam artists know that many older people have fixed incomes, which may make them vulnerable to fraud because they are open to hearing about ways to make money and pay their bills.

Where can I learn more about protecting an older person from fraud?

The National Council on Aging offers tips on avoiding fraud at EconomicCheck.org. (Click here.)

The Consumer Financial Protection Bureau offers a “Money Smart” guide for older adults, and other resources, on its website. Click here.

What should I do if I think an older person has been a victim of financial fraud?

You should report it to the local police, and your state attorney general’s office. (Click here.)You can also contact your local adult protective services agency. You can find a local agency that investigates reports of financial exploitation on the federal Eldercare Locator website (click here.) or by calling 800-677-1116.

The Justice Department also offers an online “elder abuse resource road map.” Click here.

Are older people at risk for fraud only if they are wealthy?

No, Scam artists know that many older people have fixed incomes, which may make them vulnerable to fraud because they are open to hearing about ways to make money and pay their bills.

Where can I learn more about protecting an older person from fraud?

The National Council on Aging offers tips on avoiding fraud at EconomicCheck.org. (Click here.)

The Consumer Financial Protection Bureau offers a “Money Smart” guide for older adults, and other resources, on its website. Click here.

What should I do if I think an older person has been a victim of financial fraud?

You should report it to the local police, and your state attorney general’s office. (Click here.)You can also contact your local adult protective services agency. You can find a local agency that investigates reports of financial exploitation on the federal Eldercare Locator website (click here.) or by calling 800-677-1116.

The Justice Department also offers an online “elder abuse resource road map.” Click here.

Police Twitter

If you are interested in the many jobs the City of Manassas Police Department performs, and want to go along with them on a virtual patrol, you may want to visit their interesting Twitter page which you can find here.

On this page the police share photos and interact with the community on subjects ranging from crime to vehicle safety to missing pets. If you are not already a Twitter member you can join and communicate to the force directly .

On this page the police share photos and interact with the community on subjects ranging from crime to vehicle safety to missing pets. If you are not already a Twitter member you can join and communicate to the force directly .

Scam Alerts From The Federal Trade Commission

It's amazing the amount of imagination it takes to dream up a scam. Here's a website worth reading because someday someone may try to entangle you in one of these schemes. Forewarned is forearmed.

Click here and see all the ways you can be had if you are not careful.

Click here and see all the ways you can be had if you are not careful.

Notes On Ransom Attacks From The FBI

A growing number of businesses and private individuals have experienced attacks by hackers who take over their computer systems and "lock" them up so that the owners cannot access their vital data. These cyber crooks demand a ransom to remove the digital restraints. The FBI has added this crime to their portfolio. You may want to read what they have to say about these ransom attacks including what to do if it happens to you. You can investigate what the FBI wants you to know by clicking here.